For Singaporeans Who want clarity before their next property move

How to make smarter property decisions based on your life stage, so your home supports the future you want to create.

A structured planning session for Singaporeans to decide whether to buy, upgrade, hold, or wait, with clarity and without sales pressure.

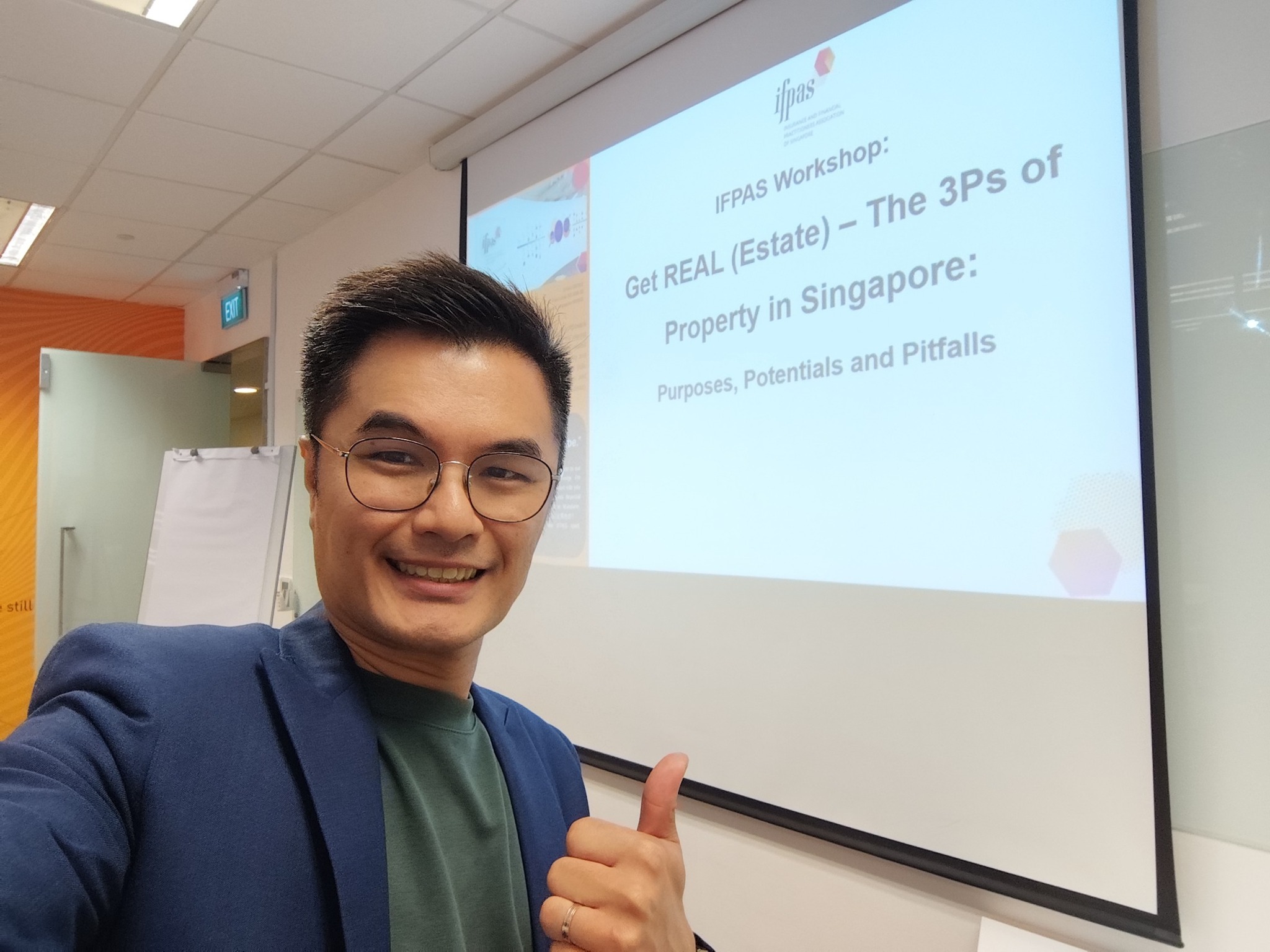

Hi, I am Derek...

If you’re feeling uncertain about your next property move, you’re not alone.

Most Singaporeans don’t struggle because they lack information. They struggle because property decisions today affect family, flexibility, and long-term security.

With 10 years of experience and over S$250 million in property transactions, I’ve helped hundreds of families navigate these decisions using data, structure, and planning, not guesswork.

I hold a Master in Real Estate from NUS, completed through a government Study Award. I’ve trained other real estate professionals, have contributed to a Ministry of National Development focus group, and my work has been featured by the Council for Estate Agencies (CEA).

Whether you’re buying your first home, upgrading, or planning long-term, my role is to help you move forward with a strategy that fits your life, not just the market.

Why Work With Me

1) I Don’t Just Sell. I Help You Avoid the Wrong Move

Most property advice stops at what you can afford today. I look at what you can sustain comfortably across different life scenarios. Your property decisions are planned around: career changes, family growth, income flexibility, long-term commitments. So you can buy, upgrade, hold, or wait with confidence, not pressure.

2) I Don’t Just Follow the Market. I Understand the System Behind It

Beyond transactions, I train other agents and contribute insights at a policy level.

This means your decisions are informed not just by market trends, but by how housing policies, risks, and structural changes affect real outcomes over time.

You’re not reacting to headlines. You’re planning with context.

3) You’re Not Just Finding a Home. You’re Planning a Life.

Many buyers move based on noise, timing fears, or external pressure.

Without a clear plan, they end up overcommitted or unsure what to do next.

This process helps you step back, see the full picture, and make decisions aligned with your life stage, family goals, and long-term direction.

How this Property Life Stage Planning™ Works

Step 1 : Listen & Learn

We begin by understanding your full situation, including your current home, finances, family plans, and lifestyle priorities, so any recommendation is grounded in your reality.

Step 2 : Life-Stage Analysis

Using the LIFE Stage Framework, we align property decisions with where you are today and what’s likely ahead, including career, family, income, and personal priorities.

Step 3: Financial & Risk Assessment

We assess not just affordability, but resilience and downside risk using the FACTS Methodology, including:

360° financial health check

C.A.R.E. risk scenario modelling

10-point asset evaluation

Property SWOT analysis

This helps you understand both upside and risk before committing.

Step 4: A Roadmap That Makes Sense

You receive a clear 5 to 15 year property roadmap outlining: when to move, what to avoid, what to prepare for, how to stay flexible. No rushing. No pressure.

Step 5: Move Forward with Clarity

Some clients proceed to buy or upgrade.

Others decide to wait and feel confident doing so.

The goal is clarity, not commitment.

Proof That Property Life Stage Planning ™ Works

How Ku's Family solve From Uncertain Upgrade to Future-Ready Home

The Ku Family

Wanted to upgrade but unsure if it was financially safe and future-proofed for career changes.

I stress-tested their finances, mapped life goals, and built a plan aligned with their 5–10 year timeline.

Upgraded to a dual-key condo, sold their HDB above expectations, and now enjoy rental income with financial peace of mind

Norm's Journey From Smart First Purchase to Freehold Upgrade

Norm

Wanted a freehold property but was unsure how to start without overcommitting.

We structured a phased approach starting with a high-potential leasehold near MRT.

Sold the first property for strong profit and upgraded to his dream freehold 3-bedder with confidence.

This Couple Didn’t Buy a Condo but We secured a spacious resale HDB

K & E Couple

Planned to buy a private condo but high lifestyle expenses made it financially risky.

I showed them how a spacious resale HDB could meet both lifestyle and investment goals.

Bought a central-area HDB, property appreciated 15%, and they’re now planning their next investment move.

Book Your Property Life Stage Planning™ Session

In just 45 minutes, we’ll help you:

A clear property roadmap based on your finances, life stage, and goals

Clarity on whether your next move should be to buy, upgrade, sell, hold, or wait

A strategy that protects your bigger goals from retirement to education and family planning

Confidence in your next step even if that step is to pause

Let’s make sure your next property decision supports your goals, your family, and your future.

© 2025 All Rights Reserved By Property Life Stage Planning™

By Submitting Your Information And Contact Details, You Agree That We May Collect, Use And Disclose Your Personal Data As Provided In This Application Form Or (If Applicable) As Obtained By Our Organisation As A Result Of Your Membership, For The Following Purposes In Accordance With The Personal Data Protection Act 2012 And Our Data Protection Policy.